US Tariff Hikes Put Global Cosmetics Manufacturing under Pressure

On April 2, 2025, US President Trump announced "reciprocal tariffs" on all US trading partners. Goods from over 180 countries and regions entering the US will be subject to a tariff of at least 10%, which took effect on April 5. In addition, higher tariffs will be imposed on countries and regions with the largest trade deficits with the US. Under this policy, the US cosmetics industry and even the global cosmetics manufacturing industry have been greatly impacted.

On April 9, local time in the US, Trump announced that the tariffs on countries other than China would be "temporarily maintained at 10%" for 90 days. But the next day, he claimed that if countries "fail to reach a satisfactory trade agreement", the "reciprocal tariffs" originally suspended for 90 days will be restored. Regardless of the policy changes, the current 10% benchmark tariff has taken effect, and many US cosmetics company executives and founders have complained to overseas fashion and beauty financial media.

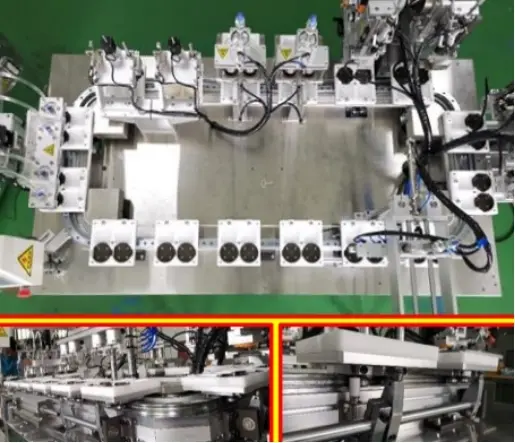

The US cosmetics industry is highly dependent on imports, and the raw materials, packaging materials, and manufacturing processes of many brands are distributed globally. David Chung, the founder of skincare brand Farmacy and the CEO of cosmetics manufacturing company iLabs, pointed out that Trump's claim that the tariff hikes are to bring "manufacturing back to the US" is almost impossible to achieve. The US lacks the production infrastructure possessed by some major cosmetics - exporting countries, such as South Korea, France, Canada, and Italy. Although some skincare products have been mass - produced in the US, higher - tech product categories like gel lip liners, liquid eyeliners, or ultra - fine ground blushes still rely on overseas production. Cosmetics formulator and beauty KOL Javin Ford said that the US basically has no production lines for pen - type products such as eyeliners and lip liners. Because these products require large - scale production and specific technologies, the core production capacity is still concentrated in South Korea.

Moreover, almost all US cosmetics brands source their packaging materials from China because the quotations from local US printing factories are too high. The cost of producing a small label in the US is several times higher than that of purchasing it in China. The owner of a US chili sauce brand once complained that his chili sauce bottle was made in a Chinese cosmetics packaging factory that specializes in producing perfume bottles. When he tried to find a factory in the US that could "replicate" this bottle, he got nothing.

For the US cosmetics industry, if the current tax rate remains unchanged, those that are highly dependent on imports will be "particularly hard - hit". For brands that do not purchase raw materials and packaging materials in the US, it has become a big problem to maintain normal operations and even survival. The founders of US cosmetics brands pointed out that behind each beauty product on the shelves of US chain retailers, there is a global and complex supply chain network. The packaging material of a box of blush may come from China, the raw material from France, the R&D in Italy, and the manufacturing in Vietnam. The product travels around the world before reaching the shelves in the US. Now the tariff policy has disrupted this chain.

Taking South Korean cosmetics as an example, in 2024, South Korea surpassed France to become the largest source of US cosmetics imports, with cosmetics from South Korea accounting for 22% of the total US cosmetics imports. If the South Korea - US trade negotiations are unsuccessful, South Korea will face a 25% tariff rate, which is undoubtedly a "heavy blow" to South Korean cosmetics that are becoming increasingly popular in the US. In recent years, with the "K - pop" craze in the US, many "Made in South Korea" beauty brands have successfully entered the dressing tables of US consumers through TikTok marketing. The innovation of South Korea in the cosmetics manufacturing industry has also made it gradually emerge as an important production base for international beauty brands. However, for these South Korean cosmetics brands entering the US, even if the factories are transferred to the US, the existing tariff rate still makes the "Made in the US" products uncompetitive in price. According to Stacey Tank, the CEO of Bespoke Beauty Brands, if the South Korean - made cosmetics under her company are transferred to the US for production, the cost will surge by "4 to 8 times", not including the time and capital investment required to build production facilities and manufacturing systems for some special products. Building the same - level beauty production capacity in the US requires an investment of "hundreds of millions of dollars" and a construction cycle of at least two to four years.

Since the production ends of various cosmetics companies are most likely to remain overseas, the Trump administration's promise of "providing jobs for US manufacturing" is difficult to fulfill, at least in the beauty sector. Even worse, in order to maintain profit margins, the US cosmetics industry is likely to become a "layoff - prone area" in 2025. Business managers may cut agency cooperation, compress warehousing space, or switch to "cheaper" raw materials and ingredients to reduce costs. Each brand has also initiated negotiations with retailers and suppliers, hoping to jointly share the new costs. Start - up brands are facing a severe financing dilemma, and some investors have withdrawn all their letters of intent.

The global cosmetics manufacturing industry is closely connected. The US tariff hikes have plunged the US cosmetics industry into a dilemma and also affected all links in the global cosmetics supply chain. Cosmetics companies in various countries are re - examining their supply chain layouts and cost structures to cope with this industry - wide turmoil caused by tariffs. In the future, the direction of the global cosmetics manufacturing industry is full of uncertainty, and the industry landscape may undergo profound changes as a result.https://www.hrdautomaticequ.com/news/